The RISQ RECAP – June 27th – July 1st, 2022

June 27th – July 1st, 2022

Each week, you’ll find specially curated news articles to keep you up to date on the ever-evolving world of insurance and risk management. The articles are divided out between items relevant to Property & Casualty, Employee Benefits/Human Resources, and Compliance. We’ve included brief summaries of each item as well as a link to the original articles.

PROPERTY & CASUALTY

Some Western U.S. Cities Nixing July 4 Fireworks over Fire Dangers, Shortages

“The skies over a scattering of Western U.S. cities will stay dark for the third consecutive Fourth of July as some major fireworks displays are canceled again this year – some over wildfire concerns amid dry weather and others because of enduring pandemic-related staffing and supply chain issues. Phoenix canceled its three major Independence Day displays because it couldn’t obtain professional-grade fireworks. Shows in several other cities around Phoenix are still on.” Full Article

– Insurance Journal

EMPLOYEE BENEFITS, HUMAN RESOURCES, & COMPLIANCE

U.S. DOL Releases Guidance on FMLA Leave and Mental Health “On May 25, 2022, the U.S. Department of Labor announced that the Wage and Hour Division (WHD) published new Family and Medical Leave Act (FMLA) Guidance. The newly issued Fact Sheet #280 explains when eligible employees may take FMLA leave to address mental health conditions, and new Frequently Asked Questions (FAQs) offer explanations on how to address various scenarios that employers and employees could face in which use of job-protected leave available under the FMLA would be appropriate.” Full Article – Epstein Becker & Green PC

NLRB Releases Spring Rulemaking Agenda Forecasting Changes to Joint Employer Standard and Representation Election Procedures “On June 21, 2022, the National Labor Relations Board (“NLRB”) released its rulemaking agenda for Spring 2022, indicating the Board is considering revisions to two significant and tumultuous topics pursuant to the rulemaking process: (1) the joint- employer standard under the National Labor Relations Act (“NLRA”), and (2) representation procedures, including those relating to blocking charges, voluntary recognition and bargaining relationships in the construction industry.” Full Article – Proskauer Rose LLP

Checking Applicant Backgrounds? Be Careful! “Background checks are a great idea — unless you fail to do them correctly. Mistakes can be costly. One online retailer paid $5 million to settle a class action filed by 454,000 job applicants alleging violations of the Fair Credit Reporting Act (FCRA), a key federal law governing the conduct of background checks. The number of such lawsuits continues to rise: it doubled between 2009 and 2018, and every year since then has marked a new high. There were 5,406 FCRA lawsuits filed in 2021 alone and, based on the 1,500 filed in the first three months of 2022, this year there will be even more. Accordingly, now is the time to take a careful look at your company’s hiring documents and the way you screen potential employees.” Full Article – Akerman LLP

You Have Mail (Better Read It): District Court Finds EEOC 90-Day Deadline Starts When Email Received “If a letter from the EEOC is in your virtual mailbox but you never open it, have you received it? Most of us are familiar with the requirement that a claimant who files an EEOC charge has 90 days to file a lawsuit after receiving what is usually required a “right-to-sue” letter from the agency. This is one of the deadlines that both plaintiff and defense counsel track on their calendars. But when is that notice officially “received” by the claimant — especially in these days of electronic correspondence? In Paniconi v. Abington Hospital-Jefferson Health, one Pennsylvania federal court decided to draw a hard line on when that date actually occurs.” Full Article – Bradley Arant Boult Cummings LLP

Metaverse in the Workplace: What Do Employers Need to Know “Emerging technologies are creating a host of new legal issues for employers. The rise of the metaverse has been one of the most anticipated expansions over the last few years. The metaverse is a virtual world that allows users to interact with each other in simulated environments. The metaverse in the workplace has been expanding rapidly as businesses explore the use of virtual reality and augmented reality to improve workflows and communication.” Full Article – Brennan Manna Diamond LLC

Employee Talent Wars Gain Unprecedented Ammunition from Changing Antitrust Landscape “The labor market has become more challenging for employers following COVID-19, and the need for well-trained, experienced employees far exceeds the supply. In addition to undermining investments in training and professional development, rampant departures are threatening the ability of employers to maintain confidential and proprietary information – including trade secrets. The legal landscape also is affecting the labor market, with enforcement of traditional non-compete agreements by employers becoming more difficult in recent years.” Full Article – Holland & Knight LLP

STATE & INTERNATIONAL COMPLIANCE

In addition to the RISQ Review, RISQ Consulting also provides a resource that features changes and updates to State and International Compliance measures. We’ve included brief summaries of each item below, and also provided links to the original articles if you’d like to read further.

D.C.

Washington, DC, Takes Steps to Protect Employees’ Off-Duty Marijuana Use

“DC city Council unanimously passed a bill on June 7. Under the act, employers cannot base an adverse employment action on (1) an individual’s legal, off-duty use of cannabis; (2) an individual’s status as a medical cannabis program patient; or (3) the presence of cannabinoid metabolites on a drug test, without additional evidence of on-the-job impairment.” Full Article

– Morgan, Lewis & Bockius LLP

Rhode Island

Rhode Island Legalizes Recreational Marijuana and Protects Off-Duty Use for Employees

“Rhode Island Governor Dan McKee signed a bill on May 25 legalizing recreational marijuana in the state. The law, which took effect immediately, prohibits basing adverse employment actions on off-duty marijuana use, unless certain limited exceptions apply.” Full Article

– Morgan, Lewis & Bockius LLP

New York

New York State Legislature Approves Statutory Protections for Independent Contractors

“New York State Freelance Isn’t Free Act, if signed by Governor Kathy Hochul, would take effect 180 days after signing and would apply to contracts entered into with certain independent contractors on or after that effective date. Employers that contract with freelancers and other independent contractors should begin to prepare for compliance, including by ensuring that any contracts will satisfy the Act’s requirements.” Full Article

– Patterson Belknap Webb & Tyler

Maryland

Maryland Employers: Your Sexual Harassment Disclosure Survey Response Is Due by July 1, 2022

“Maryland employers with 50 or more employees are required to submit a report by July 1, 2022 to the Maryland Commission on Civil Rights regarding any sexual harassment settlements during the past two years. The Maryland General Assembly passed the “Disclosing Sexual Harassment in the Workplace Act of 2018” that, in part, requires larger employers to submit two reports on sexual harassment settlements – the first of which was supposed to have occurred in 2020, and the second by July 1, 2022.” Full Article

– Shaw Rosenthal LLP

Illinois

Illinois Expands Its Bereavement Leave Act

“Illinois recently amended its Child Bereavement Leave Act to expand the reasons for leave, including miscarriage and stillbirth, and adds additional covered family members. The law will now be called the “Family Bereavement Leave Act” and goes into effect on January 1, 2023.” Full Article

– Seyfarth Shaw

- Published in Blog

Proposed Overtime Rule Expected in October 2022

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

In its recent spring regulatory agenda, the U.S. Department of Labor (DOL) announced its plans to issue a proposed overtime rule in October 2022. According to the agency’s regulatory agenda, this proposed rule is expected to address how to implement the exemption of executive, administrative and professional employees from the Fair Labor Standards Act’s (FLSA) minimum wage and overtime requirements.

The DOL provided a similar notice last fall but has yet to specify what changes it may be considering. In recent years, some experts note that the agency has contemplated modifying the duties test and salary thresholds for exempt employees.

What Will the Proposed Overtime Rule Address?

This proposed overtime rule could provide clarity for classifying exempt employees and increasing their salary levels under the FLSA. Some experts believe the DOL could even create automatic annual or periodic increases to exempt employees’ salary levels by linking them to the consumer price index, allowing exempt employees’ salary thresholds to adjust without formal rule-making. The current annual salary threshold for exempt employees is $35,568.

The DOL has held several calls with industry stakeholders and recently conducted multiple regional listening sessions to gather information. Still, there’s no firm date for when the agency will release the proposed overtime rule. Changes to minimum wage and overtime requirements under the FLSA could impact compliance costs and litigation risks for employers.

What’s Next?

Regulatory agendas outline a federal agency’s goals for the upcoming months. Although these agendas aren’t set in stone, they give insight into the current administration’s priorities and activities.

Once the DOL publishes a proposed rule in the Federal Register, there will be time designated for the public comment. Subsequently, the agency will review comments and determine whether to move forward with a final rule.

Even after the DOL publishes the proposed overtime rule, it will likely be some time before this rule becomes final, if ever. Employers are not obligated to change how they classify or pay employees until the DOL’s proposed rule becomes final. However, potentially impacted employers will want to follow the DOL’s rule-making process closely.

We will keep you apprised of any notable updates. For more resources on FLSA regulations, contact RISQ Consulting today.

- Published in Blog

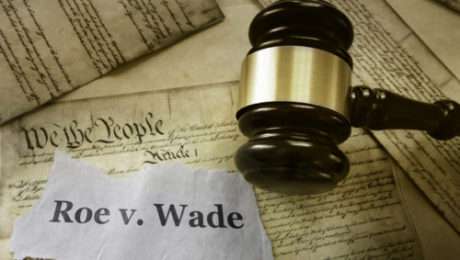

Employer Considerations for Coverage of Abortion Benefits

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

In anticipation of the U.S. Supreme Court’s decision in Dobbs v. Jackson Women’s Health Organization that overturned Roe v. Wade, states have enacted various laws regarding insurance coverage of abortion. Some states have banned or restricted abortion coverage, while other states require plans to cover abortions.

Certain states (such as Oklahoma and Texas) now enable individuals to bring civil lawsuits against anyone who assists in the performance or inducement of abortion, including paying for or reimbursing the costs of the procedure through insurance or otherwise. It is unclear whether individuals can sue companies that cover travel expenses for legal out-of-state abortions.

This Compliance Bulletin outlines the factors for employers to consider regarding providing abortion-related benefits. However, many of the issues surrounding these types of benefits remain open questions at this time. Legal challenges to these laws are already underway, and more are expected in the future.

Employers may need to closely analyze any abortion benefit offered under their group health plans to ensure full compliance with applicable restrictions. Carriers and third-party administrators may be able to provide information regarding specific plan provisions.

Depending on the situation, employers may also wish to consult with an employee benefits attorney regarding compliance.

Coverage of Abortion Benefits

There are a number of ways coverage of abortion-related expenses may be provided through a health insurance plan. Several factors may affect the benefits that are offered, such as plan funding (fully insured or self-funded), location, tax considerations and the applicable state regulation (such as whether coverage is required or prohibited).

Federal Law

Two key laws address abortion benefits at the federal level: the Pregnancy Discrimination Act (PDA), which amended Title VII of the Civil Rights Act of 1964, and the Affordable Care Act (ACA). The PDA applies to employers with 15 or more employees, including state and local governments.

Pregnancy Discrimination Act

The Pregnancy Discrimination Act (PDA) protects women from being fired for having an abortion or contemplating having an abortion. It also prohibits adverse employment actions against an employee based on their decision not to have an abortion. For example, it would be unlawful for a manager to pressure an employee to have or not to have an abortion in order to retain their job, get better assignments or stay on a path for advancement.

Insurance Coverage of Abortion

The PDA makes clear that if an employer provides health insurance benefits, it is not required to pay for health insurance coverage of abortion, except where the life of the mother would be endangered if the fetus were carried to term or medical complications have arisen from an abortion. If complications arise during the course of an abortion, the health insurance plan is required to pay the costs attributable to those complications.

In addition, an employer’s health plan is permitted to provide health coverage for an abortion, although not required. If the plan covers the costs of abortion, it must do so in the same manner and to the same degree as it covers other medical conditions. Potential problems could arise, for example, if the plan covers abortions but on different terms and conditions than those that apply to other medical conditions, or if the plan provides comprehensive medical benefits but doesn’t cover abortion when the life of the mother would be endangered if the fetus were carried to term.

| Open Issue: Whether the PDA’s protections will play a role in cases involving state anti-abortion laws. |

Affordable Care Act

The Affordable Care Act (ACA) does not require abortion coverage beyond what is already required under Title VII, as amended by the PDA. According to Executive Order 13535, the ACA was intended to maintain the abortion-related restrictions found in existing law (“Hyde Amendment” restrictions) at the time of the ACA’s enactment. Under the ACA, federal laws to protect conscience (such as the Church Amendment and the Weldon Amendment) remain intact, and new protections prohibit discrimination against health care facilities and health care providers because of an unwillingness to provide, pay for, provide coverage of or refer for abortions.

State Law

While there is no specific mandate or ban on covering abortion costs at the federal level, many states have passed their own regulations regarding abortion coverage. In the wake of the Dobbs decision, more states are likely to ban or restrict abortion coverage under all health plans. The scope of benefits that may be provided by a health plan will depend on the specific restrictions that are imposed at the state level. This section outlines key state law issues to consider.

Extraterritorial Jurisdiction

In states like Texas and Oklahoma that bar “aiding and abetting” the procurement of illegal abortions, it remains to be seen how these laws will apply to employers providing benefits for their employees to receive legal out-of-state abortions. While the plain text of the laws state that paying for or reimbursing the costs of abortion “through insurance or otherwise” is prohibited, it is unclear whether, and to what extent, this would apply to coverage of lawful out-of-state procedures. This type of jurisdictional issue will likely need to be decided in court.

| Open Issue: The extent to which one state’s insurance laws will apply to employers’ reimbursement of travel expenses for employees to procure out-of-state abortions. |

ERISA Preemption

In general, self-insured health plans are not subject to state insurance laws because of the preemption clause of the Employee Retirement Income Security Act of 1974 (ERISA). If a self-insured plan is not subject to ERISA, ERISA’s preemption clause does not apply, and the plan may be subject to state laws. Similarly, state insurance laws generally apply to ERISA-covered fully insured health plans.

ERISA preemption could potentially be used as a defense for self-insured health plans providing abortion benefits in states that regulate abortion. However, it is unclear whether a state law criminalizing the practice—or state laws that prohibit persons from “aiding and abetting” the procurement of illegal abortions—could be used against employers providing abortion benefits through self-insured, ERISA-covered plans.

| Open Issue: Whether ERISA’s preemption provisions can be used as a defense in any potential criminal or civil case brought under state anti-abortion laws. |

Tax Considerations

As with any employee benefit, employers will also have to analyze the tax treatment of abortion-related coverage. Legal abortions are considered a deductible qualifying medical expense (for which Health Savings Account, Health Reimbursement Account and Flexible Spending Account funds may be used on a tax-free basis). However, the open legal questions regarding reimbursing travel-related expenses for out-of-state abortions may also affect tax treatment. Employers may need to consult with a tax advisor on any questions regarding the tax implications of these benefits.

- Published in Blog

The RISQ RECAP – June 20th – June 24th, 2022

June 20th – June 24th, 2022

Each week, you’ll find specially curated news articles to keep you up to date on the ever-evolving world of insurance and risk management. The articles are divided out between items relevant to Property & Casualty, Employee Benefits/Human Resources, and Compliance. We’ve included brief summaries of each item as well as a link to the original articles.

PROPERTY & CASUALTY

California Railroad Testing Use of Quake Alerts to Halt Trains

“A Southern California regional passenger rail service announced that it is testing technology that will use the West Coast’s earthquake early warning system to automatically slow or stop trains before shaking begins. The five-county Metrolink system said the technology is an advancement of a previous version deployed in September 2021 that sends automated messages instructing train crews to slow or stop but does not have automated braking.” Full Article

– Insurance Journal

EMPLOYEE BENEFITS, HUMAN RESOURCES, & COMPLIANCE

Biden Administration Signals Mental Health Parity Enforcement a Priority with Fiscal 2023 Budget “The proposed budget reflects a substantial and sustained commitment to ramp up enforcement efforts, with specific funding for MHPAEA audit activity, including $275 million for the DOL over a 10-year period and $125 million for state grants to support their MHPAEA enforcement efforts.” Full Article – Akerman

Can Our DCAP Reimburse a ‘Hold-the-Spot’ Fee? “Although the regulations do not specifically address hold-the-spot fees of the type your participant has asked about, an IRS official has informally commented that a hold-the-spot fee may qualify as an indirect expense if it must be paid to obtain care when the leave is over.” Full Article – Thomson Reuters / EBIA

Preventive Care May Be Free, But Follow-Up Diagnostic Tests Can Bring Big Bills “Under the ACA, many preventive services — such as breast and colorectal cancer screening — are covered at no cost. But if a screening returns an abnormal result and a health care provider orders more testing to figure out what’s wrong, patients may be on the hook for hundreds or even thousands of dollars for diagnostic services.” Full Article – Kaiser Health News

TPA’s Administrative Activities and Handling of Plan-Related Funds Did Not Make It a Plan Fiduciary “The Hi-Lex decision likely made many TPAs uneasy, so they will appreciate that this court has called the Sixth Circuit’s reasoning into question. Plans and TPAs will want to keep an eye on this case. The plan has appealed to the First Circuit, which may reach a different conclusion, potentially leading to a circuit split and consideration of the issue by the U.S. Supreme Court.” Full Article – Thomson Reuters / EBIA

CMS Imposes First Price Transparency Rule Penalties “On June 7, 2022, CMS fined Northside Hospital Atlanta, in Atlanta, Ga., $883,180, and Northside Hospital Cherokee, in Canton, Ga., $214,320. CMS has stated that these fines are due to the hospitals’ failure to have a consumer-friendly, searchable list of standard charges posted in a prominent manner that clearly identified the location of the hospital. CMS further noted that the hospitals failed to include all required services in a machine-readable file, and services weren’t included in a single file, as required by the Rule.” Full Article – Husch Blackwell

When Will the Pandemic Be Over for Employer Health Plans? “As of June 15, 2022: [1] The National Emergency will end on February 28, 2023; [2] The Public Health Emergency will end on October 12, 2022; and – Foley & Lardner LLP

[3] The HDHP/telehealth provision expires on December 31, 2022. HHS has indicated that they will give the public at least 60 days’ notice before the formal end to the Public Health Emergency.” Full Article

STATE & INTERNATIONAL COMPLIANCE

In addition to the RISQ Review, RISQ Consulting also provides a resource that features changes and updates to State and International Compliance measures. We’ve included brief summaries of each item below, and also provided links to the original articles if you’d like to read further.

California

Local Minimum Wage Set to Increase July 1

“A statewide minimum of $15.00 for all businesses was scheduled to go into effect on January 1, 2023. However, as a result of rates of inflation of over 7%, a further statutory increase has been triggered and the

statewide minimum wage will now increase to $15.50 on January 1, 2023.” Full Article

– Jackson Lewis

New Jersey

New Jersey Employers: Plan Ahead for the Long-Delayed Overhaul of the State’s WARN Act

“On January 21, 2020, months before the COVID-19 pandemic emerged in the United States, New Jersey Governor Phil Murphy signed into law New Jersey Senate Bill 3170, ushering into law significant amendments to the Millville Dallas Airmotive Plant Job Loss Notification Act (NJ WARN Act), New Jersey’s state law counterpart to the federal WARN Act. Originally set to take effect in July 2020, the pandemic set into motion a series of postponements. ” Full Article

– Duane Morris

New York

New York City Wage Transparency Law Guidance Issued

“On May 12, 2022, the New York City Commission on Human Rights released a fact sheet providing guidance on the amended NYC salary transparency law, which is currently set to take effect on November 1, 2022. The amended salary transparency law requires NYC employers to include minimum and maximum salary information in job postings for any position located within New York City.” Full Article

– Patterson Belknap Webb & Tyler

Michigan

Wage and Hour Law 101 for Employers

“Effective on January 1, 2022, the statewide minimum wage in Michigan was increased to $9.87/hour for regular hourly workers, a 22-cent raise over 2021. Exceptions to the law are for tipped workers, the rate is $3.75, as long as reported tips average $6.12, 17 and 17-year-olds, whose rate was increased to $8.39, and training wages for 16-19-year-olds for the first 90 days of their employment, which stands at $4.25/hour.” Full Article

– Foster Swift

Illinois

Amendments To Illinois’ One Day Rest in Seven Act Mitigates Against Hunger Pangs and Rest Deprivation

“Illinois Governor J.B. Pritzker signed into law SB3146, amending the provisions of the Illinois One Day Rest in Seven Act (ODRISA), which addresses both day of rest and meal break requirements for employees in the state. Fortunately for employers, the amendments do not take effect until January 1, 2023, so there is plenty of time for Illinois employers to make sure their policies and process conform to these changes, which are significant.” Full Article

– Seyfarth Shaw

- Published in Blog

Fuel Efficiency Best Practices for Fleets

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

Improving the fuel efficiency of a company’s fleet of vehicles can have many financial and environmental benefits, especially with fuel prices on the rise. Fuel can be one of the largest and most difficult expenses to predict and control. Therefore, it’s important for vehicle fleet managers to conserve fuel, maximize efficiency and reduce vehicle emissions by implementing fuel-efficient policies, technology and maintenance strategies.

Best Practices

Managing a fleet’s fuel usage—even for just a couple of vehicles—can feel overwhelming. The following are ways to reduce fleet fuel costs and make operations more efficient:

- Monitor driving patterns. A U.S. Department of Transportation report found that there can be as much as a 35% difference in fuel consumption between a good and poor driver. Monitoring speeding, braking and acceleration patterns can indicate whether drivers are using good practices on the road or operating inefficiently.

- Cut engine idling. Idling can burn a quarter to a half gallons of fuel per hour. To reduce fuel and oil waste:

- Turn off the engine while waiting or making deliveries.

- Turn off the engine while stuck in traffic.

- Do not idle to warm up the engine.

- Improve route efficiency. Route efficiency can be improved with GPS tracking technology to ensure operations are streamlined and drivers don’t spend their day and fuel driving back and forth.

- Remove unnecessary weight from vehicles. Every extra 100 pounds in a vehicle can increase gas costs by up to $0.03 cents per gallon, which can quickly add up over the course of hundreds of thousands of gallons across multiple vehicles. Only travel with necessary packages or equipment.

- Schedule maintenance. Preventive and regular maintenance can reduce fuel costs, extend the lifespan of fleet vehicles and ensure the safety of drivers and the community.

- Check the tire pressure. Tires should be inflated to 75% of the recommended pressure; underinflated tires can significantly lower a vehicle’s average gas mileage. Checking the tire pressure should be a mandatory part of the pre-trip safety check since it not only improves the cost per mile but also helps the vehicle respond properly in unsafe situations.

- Dispatch the closest vehicle. Business margins and fuel efficiency can be improved by dispatching the closest vehicle to a new delivery or appointment. Fleet-tracking programs can help automate dispatching and routing.

- Leverage a fleet telematics solution. A fleet telematics solution can help managers gain data and insight into fleet status in terms of individual vehicle performance and overall operations, allowing them to make changes that will help fuel efficiency.

- Provide incentives. Fleet managers can encourage efficient driving by offering drivers incentives, such as recognition or special privileges.

- Implement driver training. Providing drivers with training regarding fuel-efficient habits can increase their awareness of fuel efficiency on the road. It can help them be mindful of things like keeping gears low when accelerating, changing gears early, driving at slower speeds and learning to read the road more effectively.

By implementing policies and practices that monitor and reward fuel-efficient behavior, fleet operations can reduce fuel costs. For more risk management guidance, contact us today.

- Published in Blog

Combating Rising Benefits Costs During Periods of High Inflation

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

The U.S. inflation rate has increased by 8.3% over the last year, according to the Bureau of Labor Statistics (BLS). This has led to significant price increases across various consumer goods as well as employee benefits such as health insurance. In fact, one-third of U.S. employees have already seen an increase in their health costs in the last year, a survey conducted by the Employee Benefit Research Institute reported.

This increase in costs presents challenges for employers facing one of the most difficult hiring markets in recent memory. Luckily, there are some strategies employers can utilize to mitigate increasing benefits costs without shifting the burden to employees, thus remaining attractive to current and prospective employees.

Eliminate Underutilized Benefits

One simple strategy is to eliminate underutilized benefits. Resources from unused benefits can then go towards more expensive benefits. An easy way to evaluate which benefits best suit a company’s needs is to regularly send out benefits surveys to the company’s employees. These surveys can help employers know which available benefits may not be providing value to the company.

Wellness Programs

While there are skeptics and believers when it comes to actual cost savings provided by wellness programs, they often play an important role in other positive workplace developments. For instance, promoting and achieving a healthy workforce often improves morale and productivity. These programs are also valuable because they can lead to improved employee attraction and retention as well as increased loyalty to the employer.

There are a variety of wellness benefits employers can offer to suit the needs of their company. Potential options include providing in-office perks for nutrition, fitness and stress management, or gym memberships.

Telemedicine

Taking time off to go to the doctor can often be a time-consuming and expensive undertaking. Telemedicine may help lessen these issues by eliminating associated costs, such as transportation, and providing faster and more affordable care to those seeking medical services. By meeting with health care providers over the internet, employees can get the care they need more quickly and are likely to be more productive as a result. Additionally, telemedicine allows employees to take less paid time off of work and makes it much easier for them to avoid obstacles that could get in the way of seeking health care, such as child care.

Conclusion

As employers adjust to increasing inflation rates and the rising costs that follow, there are several strategies they can use to help offset the severity of these increases. From providing wellness programs to facilitating the use of telemedicine, employers will need to think carefully about which strategy would work best for their unique situation.

Contact us today for more inflation-related content.

- Published in Blog

The RISQ RECAP – June 13th – June 17th, 2022

June 13th – June 17th, 2022

Each week, you’ll find specially curated news articles to keep you up to date on the ever-evolving world of insurance and risk management. The articles are divided out between items relevant to Property & Casualty, Employee Benefits/Human Resources, and Compliance. We’ve included brief summaries of each item as well as a link to the original articles.

PROPERTY & CASUALTY

Insurers Increasingly Concerned for Western U.S. Wildfire Season

“As Western wildfires force evacuations in Arizona and California – on the heels of an early and severe wildfire season in New Mexico – insurers are increasingly eyeing the growing risks. ‘Insurers are very much concerned about the wildfire situation,’ said Arindam Samanta, director of product management for Verisk Underwriting Solutions. ‘We are talking to dozens of insurers.’” Full Article

– Insurance Journal

EMPLOYEE BENEFITS, HUMAN RESOURCES, & COMPLIANCE

Employers: Take Steps Now to Prevent Workplace Violence and Protect Employees “The rise in workplace violence, and violence in general, should prompt employers to consider what they can and should do to protect their employees, customers, and business. It is especially important to do so now, as more and more employers are requiring their employees to return to work in person following the pandemic.” Full Article – Akerman

‘That’s So Meta:’ Workplace Harassment Issues in a Virtual World “With the advent of virtual reality (VR) games, increasing numbers of players can now interact online to play games in a digital environment called a “metaverse.” VR headsets allow the players to immerse themselves in the digital environment, divorced from the tangible, natural world. AR and VR technology is rapidly developing beyond the gaming applications to internal and external business applications.” Full Article – State Bar of Wisconsin

EEOC Issues Guidance Addressing How the Use of Artificial Intelligence in Employment Decisions Could Violate the ADA “On May 12, 2022, the United States Equal Employment Opportunity Commission (“EEOC”) issued technical guidance addressing how an employer’s use of software, algorithmic decision- making tools and AI to assist them in hiring workers, monitoring worker performance, determining pay or promotions, and establishing the terms and conditions of employment could violate the Americans with Disabilities Act (“ADA”).” Full Article – Mintz Levin

Website Compliance with the ADA: Is Your Company Compliant With the Latest DOJ Guidance? “While commercial businesses are typically aware of their responsibilities under the Americans with Disability Act (the “ADA” or the “Act”) relative to the maintenance of their physical office spaces and general corporate policies, some businesses have been the recipients of demand letters alleging violations of the ADA based on a purportedly non-compliant website. Financial institutions in particular, as well as other businesses that maintain significant operations through online customer portals, have been the primary focus of these efforts.” Full Article – Krieg Devault

Women Leaders Excel in Times of Crisis: Lessons Learned and a Call to Action “U.S. The pandemic’s negative impact on women in the workforce is unlikely to reverse anytime soon. In the first year of the pandemic alone, 54 million women around the world left the workforce-almost 90% of whom exited the labor force completely. As reported recently in the Harvard Business Review, “[t]he participation rate for women in the global labor force is now under 47%, drastically lower than men at 72%.” Women are currently at their lowest labor force participation rates since 1977. As one commentator recently reported, women are quitting their jobs at a rate 22% higher than men.” Full Article – Robins Kaplan

Is “Tenure” a Euphemism for Age? “The U.S. Court of Appeals for the Fifth Circuit nonetheless found that a manager’s stated refusal to hire “tenured employees” was not direct evidence of age discrimination in this particular case. As the Fifth Circuit explained, comments will constitute direct evidence of discrimination when they are 1) related to the protected class of persons of which the plaintiff is a member; 2) proximate in time to the complained – Shawe Rosenthal

-of adverse employment decision; 3) made by an individual with authority over the employment decision at issue; and 4) related to the employment decision at issue. If these criteria are not met, such comments are considered “stray remarks” that will not, by themselves, support a claim of discrimination.” Full Article

STATE & INTERNATIONAL COMPLIANCE

In addition to the RISQ Review, RISQ Consulting also provides a resource that features changes and updates to State and International Compliance measures. We’ve included brief summaries of each item below, and also provided links to the original articles if you’d like to read further.

California

Local Minimum Wage Set to Increase July 1

“A statewide minimum of $15.00 for all businesses was scheduled to go into effect on January 1, 2023. However, as a result of rates of inflation of over 7%, a further statutory increase has been triggered and the

statewide minimum wage will now increase to $15.50 on January 1, 2023.” Full Article

– Jackson Lewis

New Jersey

New Jersey Employers: Plan Ahead for the Long-Delayed Overhaul of the State’s WARN Act

“On January 21, 2020, months before the COVID-19 pandemic emerged in the United States, New Jersey Governor Phil Murphy signed into law New Jersey Senate Bill 3170, ushering into law significant amendments to the Millville Dallas Airmotive Plant Job Loss Notification Act (NJ WARN Act), New Jersey’s state law counterpart to the federal WARN Act. Originally set to take effect in July 2020, the pandemic set into motion a series of postponements. ” Full Article

– Duane Morris

New York

New York City Wage Transparency Law Guidance Issued

“On May 12, 2022, the New York City Commission on Human Rights released a fact sheet providing guidance on the amended NYC salary transparency law, which is currently set to take effect on November 1, 2022. The amended salary transparency law requires NYC employers to include minimum and maximum salary information in job postings for any position located within New York City.” Full Article

– Patterson Belknap Webb & Tyler

Michigan

Wage and Hour Law 101 for Employers

“Effective on January 1, 2022, the statewide minimum wage in Michigan was increased to $9.87/hour for regular hourly workers, a 22-cent raise over 2021. Exceptions to the law are for tipped workers, the rate is $3.75, as long as reported tips average $6.12, 17 and 17-year-olds, whose rate was increased to $8.39, and training wages for 16-19-year-olds for the first 90 days of their employment, which stands at $4.25/hour.” Full Article

– Foster Swift

Illinois

Amendments To Illinois’ One Day Rest in Seven Act Mitigates Against Hunger Pangs and Rest Deprivation

“Illinois Governor J.B. Pritzker signed into law SB3146, amending the provisions of the Illinois One Day Rest in Seven Act (ODRISA), which addresses both day of rest and meal break requirements for employees in the state. Fortunately for employers, the amendments do not take effect until January 1, 2023, so there is plenty of time for Illinois employers to make sure their policies and process conform to these changes, which are significant.” Full Article

– Seyfarth Shaw

- Published in Blog

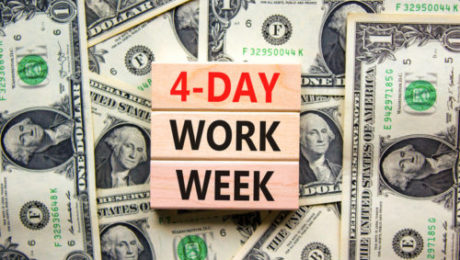

Updates on the Four Day Work Week

By Ashley Snodgrass, Employee Benefits Analyst

Employers are reaching for new tactics in the war for talent. Beyond a rich benefit package, solid leadership, and opportunities to improve, employers are innovating to set themselves apart from the competition.

I write as neither an advocate nor adversary of this movement. My goal is not to highlight the challenges or the benefits. Instead, I invite you to investigate the motives behind the movement, and evaluate whether why or why not the four-day work week would benefit your company.

First, let’s understand the definition of the four-day work week. The idea is not to shift to a 10-hour day schedule, 4 hours a week, for the same 40-hour work week. Instead, a 34-hour work week (4 days a week, 8.5 hours a day) is commonly proposed. The intention is still to maintain the same level of productivity as in a 40-hour work week, same level of pay, but with a renewed focus on work-life balance, with three days off each week.

Companies who are trying this out have been met with a wealth of benefits. Increased retention, increased applicants for jobs, and improved wellness among employees to name a few. The first pioneering companies paved the way with such success, that entire countries are now considering the data, and running their own tests. Currently, the U.K. launched a six-month experiment with 70 companies to test out the four-day work week.

I’ve included links to several articles below that highlight the four-day work week. I encourage you to read through them when evaluating the needs of your company.

Resource Round Up: About the Four Day Work Week

- Published in Blog

Task Oriented or Relationship Oriented

By Shayla Teague, Individual and Family Benefits Consultant

I had the opportunity recently to take a life changing course on social styles through the Wilson Learning Company. This course forced me to take a deep dive into my own communication style and learn to recognize the communication styles of others. It has helped me to not take offense to people that have different styles than my own and flex to their style of communication. All around, this has allowed me to foster more meaningful dialogue, especially in high-stress conversations.

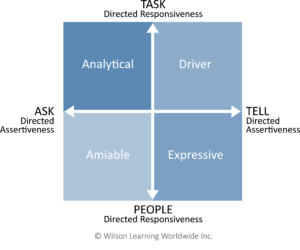

There are four main styles: Analytical, Driver, Amiable, and Expressive. Each style sits in an area of a quadrant that determines if their communication style is more assertive or less assertive and more task oriented or more relationship oriented. Knowing where you sit on the quadrant can help you understand your communication style. This is done through a test offered by Wilson Learning. I will explain each style in more detail.

Analytical

Tends to work in facts and figures, needs more time to analyze a project, often more serious in demeanor, likely explains in great detail. A person with a dominant analytical personality tends to be less assertive and more task oriented. They aren’t too comfortable discussing emotions. They are likely to ask vs. tell. “Will you please provide the CPA Report.”

Driver

More results focused. They don’t need all the details in how you got to the end result, they just want the end result. They value actions and results and don’t need to spend a lot of time on the planning aspect. A driver tends to be more assertive and more task oriented. They don’t like to hear emotion when it comes to work. They are likely to tell vs. ask. “I need the CPA report by 2pm.”

Amiable

Tend to have high empathy, avoid conflict, want the general consensus of the group, and are team and relationship focused. An amiable person will really focus on how a decision will impact the people in a group. They are less assertive and more relationship oriented. Communications likely focus more on emotion and feelings.

Expressive

Tend to be more animated and impulsive. They tend to have many ideas and have a hard time sticking to just one. Expressive personalities have a lot of ambition and enthusiasm, however they tend to be more spontaneous. They are more assertive and more relationship oriented.

People do not fit in a box, so we all are not one of these categories and some of our traits likely fit into all four. Everyone has a dominate style and a secondary style and your style is likely to remain the same throughout your adult life. During the course we watched videos of the most extreme scenarios as we were learning to recognize other people’s styles by their behavior, communication and even hand gestures or how much eye contact they make.

My dominant personality is analytical as you may have already caught onto by the writing style of this article. The analytical in the video was portrayed as rigid and standoffish. We were asked if any of us disagreed with our style and I raised my hand and continued to explain why there is NO WAY I could be a dominant analytical. A colleague of mine interjected and pointed out, “Shayla, you are analyzing why you are not an analytical.” Alas, I had to concede to that.

So how does this all play into communication? Surely, we are all aware that people are different and have different ways of communicating. That is where flexing to other styles comes into play and why it is helpful to be able to identify another person’s style. I had a supervisor that was a driver, driver. That means both his dominant and his secondary style fell within the driver quadrant. I always wanted to go into major detail about all the steps that I took to complete a project. It was disheartening for me when he just wanted the results and thought my e-mails were too long. It can be exhausting for a driver to listen to all the details when they just want you to get to the point. Because of the training I was able to recognize him as a driver and so I was able to adjust the way that I communicated projects with him. I could just give him the necessary information and leave out the fluff. If I am communicating the same project to an amiable style, they may think I am being abrasive by communicating in this manner. I may want to keep some of the fluff or emotion in my communication.

Knowing your style and being able to recognize the style of others can help communication immensely. This is especially the case if you are in a supervisory role. Flexing to the style of your employee can help them feel valued and heard.

Source and link to Wilson Learning Course and Handbook:

https://global.wilsonlearning.com/resources/hidden-cost-comm/

https://global.wilsonlearning.com/resources/the-social-styles-handbook/

- Published in Blog

- 1

- 2

Subscribe to the RISQ Recap, a weekly post to help you stay up to date on news articles and resources for your organization’s compliance needs.

Subscribe to the RISQ Recap, a weekly post to help you stay up to date on news articles and resources for your organization’s compliance needs.