The RISQ RECAP:

September 26th – September 30th, 2022

Each week, you’ll find specially curated news articles to keep you up to date on the ever-evolving world of insurance and risk management. The articles are divided out between items relevant to Property & Casualty, Employee Benefits/Human Resources, and Compliance. We’ve included brief summaries of each item as well as a link to the original articles.

PROPERTY & CASUALTY

Revealed – The Top Five Insurtech Trends Reshaping America’s Insurance Landscape

“The insurtech space continues its rapid ascent as manifested in the market’s growing range of capabilities and business models – and those who will benefit the most, according to experts, are the insurance companies and investors with a deep understanding of “emerging technology and commercial trends.”” Full Article

– Insurance Business America

EMPLOYEE BENEFITS, HUMAN RESOURCES, & COMPLIANCE

What New Student Loan Relief Means for Employee Benefits “Employers may want to consider building in flexibility to their education assistance programs and to any matching contributions offered through coordination of such a program and a 401(k) plan benefit. If proposed measures take effect, more individuals will be eligible for $0 monthly income- based payment amounts in the future. Employers that do not currently offer education assistance programs may want to consider adding one by January 1, 2023, as many borrowers’ priorities will be shifting from retirement savings to student loan repayments then.” Full Article – Ogletree Deakins

Federal Court Finds Key Part of ACA’s Preventive Service Mandate Unconstitutional “The court found that U.S. Preventive Services Task Force (USPTF) members were principal officers who must be nominated by the President and confirmed by the Senate. The court noted that USPTF was not part of HHS or another agency and its members are not directed or supervised by someone appointed by the President and confirmed by the Senate. Further, the court agreed with the plaintiffs that the requirement to cover PrEP to prevent the transmission of HIV violates the RFRA because it substantially burdened their religious exercise.” Full Article – The Wagner Law Group

Employee Benefits in the United States, March 2022 “Life insurance was available to 57 percent of private industry workers in March 2022. Forty- three percent of private industry workers had access to short-term disability insurance. Thirty-five percent of private industry workers had access to long-term disability insurance. Wellness programs were available to 43 percent of private workers.” Full Article – U.S. Bureau of Labor Statistics (BLU)

Final Rule Changes No Surprises Act Requirements “The Final Rule addresses specific disclosure requirements for group health plans and health insurance issuers related to the Qualified Payment Amount (QPA) for out-of-network (OON) services and sets forth the factors and information which certified Federal Independent Dispute Resolution (IDR) entities must consider in arbitrating disputes for OON services or items. The Final Rule is effective October 25, 2022, for services/items rendered during plan years beginning or after January, 1, 2022.” Full Article – Sheppard Mullin

The Inflation Reduction Act Has Been Signed Into Law and Includes Key Health Provisions “The IRA provides a safe harbor that allows high deductible health plans (HDHPs) to cover insulin before the participant meets the HDHP’s deductible without adversely affecting the participant’s health savings account (HSA) eligibility. In addition, the IRA establishes a system for Medicare to negotiate drug prices with manufacturers, which has the potential to raise group health plans’ costs in the future because employer group health plans are not eligible for the negotiated drug price rates or the rebates.” Full Article – Miller Johnson

Three Key Strategies for Defending MHPAEA Claims: Preparing for the Lawsuit Before It Is Filed “[1] Carefully review plan terms related to the benefits that are frequently the target of MHPAEA claims and the medical/surgical treatments that plaintiffs typically claim are analogs for these treatments. [2] Confirm that the processes for designing and applying coverage limitations are well- documented and in compliance with MHPAEA’s requirements. [3] Confirm that processes are in place to comply with MHPAEA’s disclosure requirements in response to participant document requests. Such requests are an ‘early warning’ that a MHPAEA lawsuit may be coming.” Full Article – Groom Law Group

STATE & INTERNATIONAL COMPLIANCE

In addition to the RISQ Review, RISQ Consulting also provides a resource that features changes and updates to State and International Compliance measures. We’ve included brief summaries of each item below, and also provided links to the original articles if you’d like to read further.

NEW JERSEY

Changes to Posting Requirements Prompt Jersey Employers to Ensure Compliance

“The New Jersey Division on Civil Rights (DCR) recently published final regulations that change the content of certain required notifications New Jersey employers must provide to employees. On August 1, 2022, the DCR announced that these changes are effective immediately and are intended to better inform individuals of their rights under the New Jersey Law Against Discrimination (LAD) and the New Jersey Family Leave Act (FLA). Regulations under the LAD and FLA require covered employers to (1) “display” the official posters in “easily visible” places and (2) “provide” each employee with a copy of the official posters annually and upon an employee’s first request.” Full Article

– Duane Morris LLP

OREGON

Rules Governing Oregon’s New Paid Family and Medical Leave Insurance Program and Equivalent Plan Application Process

“On July 22, 2022 and August 22, 2022, the Oregon Employment Department (OED) published its latest rules governing Oregon’s new Paid Family and Medical Leave Insurance (PFMLI) program. The PFMLI program will be funded by employer and employee contributions in the form of payroll deductions beginning January 1, 2023 and will provide employees with up to 12 weeks of paid time off for leave that qualifies as family, medical, or safe leave, absent undue hardship, beginning on September 3, 2023.” Full Article

– Littler Mendelson PC

MICHIGAN

The Michigan Supreme Court Holds that Discrimination on the Basis of Sexual Orientation is Prohibited by the Elliott-Larsen Civil Rights Act

“On July 28, 2022, in a 5-2 opinion, the Michigan Supreme Court held that the prohibition of discrimination “because of… sex” in the Elliott-Larsen Civil Rights Act (“ELCRA”) includes discrimination on the basis of sexual orientation. Rouch World LLC v Department of Civil Rights, No. 162482, July 28, 2022.” Full Article

– Dickinson Wright

MISSISSIPPI

Protections for Employers Under the New

“Mississippi Medical Cannabis Act that was signed by Gov. Tate Reeves in February 2022 was written in a way to protect employers. Here are some protections that employers will see under the new law. Some of the protections offered are; employers are not required to pay for or reimburse any individual or entity for cost associated with the medical use of cannabis, no employer is required to permit or accommodate the medical use of cannabis and employers are not prohibited from hiring or discharging the privilege employment because of an individual’s use of medical cannabis.” Full Article

– Phelps Dunbar LLP

CALIFORNIA

California Creates Unelected Council to Set Minimum Wages/ Working Conditions of 500,000 Fast Food Workers

“On September 5, 2022, Governor Gavin Newsom signed the Fast Food Accountability and Standards Recovery Act or FAST Recovery Act (AB-257). The state government, which is dominated at all levels by union-friendly politicians, will appoint a 10-member Council composed of employees, employers and “union activists” to set the minimum wages and working conditions of fast food workers in the state – however, the new Council will only have jurisdiction over non-unionized fast food restaurants. Since unionized restaurants will be exempted from the law, they will be free to pay their employees lower wages and benefits than those set by the Council.” Full Article

– Proskauer Rose LLP

- Published in Blog

The Great Reconsideration: Looking Ahead to the Next Stage of the Labor Market

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

The labor market continues to be unpredictable and driven by new challenges. As such, economists have signaled that the labor market is moving into another phase. Previously, there have been trends labeled as the Great Resignation and the Great Reshuffle. The Great Resignation referred to a mass movement of workers leaving the workforce. In contrast, the Great Reshuffle illustrated workers quitting one job they are unsatisfied with to take another—which has been a more accurate assessment. There has not been a mass exodus from work itself, as the term the Great Resignation suggested. While these terms still hold some truth to the current state of the market, some economists have even used a new term to describe the current worker sentiment: the Great Reconsideration. Instead, workers are seizing the unprecedented opportunity to reconsider and change their work experiences. They’ve had time to reflect on their jobs and consider opportunities with a fresh perspective.

This article examines the current labor market, highlights driving trends and offers tips for employers navigating the market.

Market Overview

The most recent U.S. Bureau of Labor Statistics (BLS) report revealed that the number of job openings rose to 11.2 million in July. This number was well above the estimate and still outnumbered unemployed workers by about 5.5 million. The July BLS numbers reinforced that there is still a considerable shortage of workers for available positions, with openings outnumbering available workers by a nearly 2-to-1 margin.

Employee quits, a top worker confidence metric, dropped from a record-high 4.53 million in March to 4.18 million at the end of July. The report also revealed that the employee quit rate declined one tenth of a percentage point to 2.7%. Nonetheless, this number is still relatively high by historical standards.

Additionally, the unemployment rate has not yet reached pre-pandemic levels. In July, the rate sat at 3.7%. In a regular labor market, this could be a troubling sign; however, it indicates that the job market could be on its way to normalizing. From a retention and attraction perspective, these numbers further illustrate that it’s a worker-friendly market.

The struggle to fill positions and related challenges have increased labor costs for employers as they raise wages and offer competitive benefits and other perks to attract talent. The market trends also demonstrate that workers remain confident enough to switch jobs for better pay and working conditions despite economic pressures like inflation.

Driving Trends

The COVID-19 pandemic undoubtedly shifted the playing field for workers and organizations. Now, amid the Great Reconsideration, both parties are reevaluating various aspects of the workplace and the workday.

Many employers are reassessing what workplace accommodations or transformations have—or have not— worked and what can be done to improve employee engagement and satisfaction. Simultaneously, workers are reconsidering their career goals and expectations for an employer.

Hybrid Work

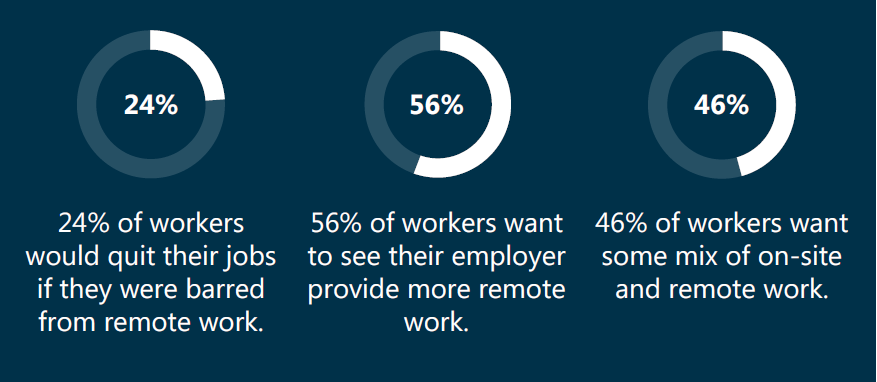

Hybrid work continues to be a catalyst for modern workplace challenges. As such, more on-site workers want to leave their jobs than remote workers, according to a survey from professional services network KPMG. Consider the following additional statistics:

Many workers desire a hybrid workplace model to have more face-to-face time with their co-workers. The camaraderie with colleagues is a top reason why workers want to be in the office or similar settings part-time. Other motivators include creating a work-life balance, getting out of the house or benefiting from a regular change of environment. In the end, workers are looking for solid and united company cultures—and employers have an opportunity to act on this desire as they reconsider their workplace expectations and strategies. Employers who embrace hybrid work models may see improvements in employee productivity, morale and, most critically, retention.

Long COVID and the Labor Market

Long COVID-19—long-term effects stemming from COVID-19 infection—continues to impact the labor market and employees’ health. The U.S. Census Bureau’s latest Household Pulse Survey found that 16.3 million working-age Americans currently have long COVID. It has been reported that long COVID is even keeping some workers out of employment; an estimated 4 million workers are out of the labor market, according to Brookings Institution’s nonresident senior fellow Katie Bach.

Long COVID can pose serious risks for employers, including decreased productivity and the loss of employees from the workforce entirely. Therefore, they must stay up to date on trends surrounding the condition’s rates and other related topics, such as strategies other employers are using to respond to long COVID.

Salaries and Job Hopping

HR services provider ADP reported that salaries have been increasing rapidly, nearly on par with inflation. Annual pay raises rose by 7.6% in the period leading up to August 2022, compared to an average of 2% in early 2021. However, the most significant raises went to job hoppers. Those who found different jobs experienced salary gains of 16.1%, while employees who stayed loyal to a company received an average increase of 7.6%.

Looming Recession

As the Federal Reserve struggles to tame skyrocketing prices, employers and employees alike are worried about entering a recession. Some might even say a recession has already begun. The reality for many business owners due to the employment market is slower growth and rising labor costs. As a result, many organizations have experienced or are planning layoffs and hiring freezes in the back half of this year.

What Are Employers Doing?

Although the Great Reconsideration is currently taking place, new labor challenges will likely surface. All employers can do is face the moment and put together a game plan. As a thought-starter, here are strategies some organizations are using to win over talent:

- Review compensation. As employers and employees continue to be hit by inflation, organizations should start reviewing and assessing their current compensation and benefits. It could be helpful to analyze pay raises from similar companies based on industry or geographic location.

- Reimagine company culture. Just as workers are reconsidering what they want for work and an employer, an organization can reevaluate its goals and what kind of employer they want to be. Company culture can be an organization’s best protection against losing employees—and offer a leg up on attracting new employees. There is usually a gap between organizational leadership and what employees experience, so there’s a need to keep it aspirational but realistic.

- Rethink perks. Flexibility is no longer a generous workplace perk. It’s a significant perk, but many employees already have a flexible working schedule or expect it from prospective employers. With remote or hybrid work becoming table stakes, employers will have to stand out against the competition with other unique perks (e.g., four-day workweek and flexible hours).

- Prioritize real-time over real-life connections. Workplace connection has often been thought of as something that happens during the workday in the hallway, at the coffee station or in other communal areas. However, employers can still plan for real-life connections without requiring employees to be working on-site all day. This can be achieved by making real-time communication a habit for employees by providing tools, opportunities and encouragement to connect. Employers are considering ways to create intentional spaces for peer connection that don’t necessarily involve day-to-day work.

- Invest in career growth. With many workers reevaluating their career goals and paths, employers can invest in workers by expanding learning and development opportunities. Employers can enhance their staffing and worker skill levels by offering employees a chance to enrich their careers via upward mobility. Forward-thinking organizations will plan to recruit and retain employees for the skills needed today—and in the future.

In the end, many employers are reinventing their company culture to account for adjusted organizational mission and values, company culture and employee expectations.

Summary

Generally, job openings remain high as the demand for workers outweighs the supply. Many employers are at a disadvantage and struggling to fill positions. Unfortunately, experts expect talent challenges to continue. Yet, forward-thinking organizations are benefiting when they remember that workers are human. Workers are looking for an employer who matches their style, needs and beliefs. They want to work where they feel care and support from their employers. As the Great Reconsideration is in progress, employers will have to find ways to make their culture and workplaces look and feel authentic and reliable. Employers should continue to monitor employment trends in the evolving market to stay competitive. Contact us for more resources.

- Published in Blog

Precious

By Kevina “Liz” Mitchell, Employee Benefits Account Specialist

Nava sat staring out of the window, some sunny Sunday. The trees had begun to shed their clothing in preparation to sleep in Winter’s embrace. The fallen leaves danced and played at the tickling of the wind. The sky was blue. And her coffee was especially delicious that day.

She cupped her coffee cup in her aged hands. It was her favorite coffee cup. Her son, now 43, had made it for her in his high school art class. It had all the potential of youth and dreaming, but in execution it bore the marks of inexperience, and the clumsiness of growing fingers. The handle was crooked and thin, useful only for aesthetics. The lip was too thick in one place and thin enough to slice her lips in another. She learned that the hard way. There was a spot opposite of the handle that was perfect, and that is where she drank from. He had painted it to look like Robin from Teen Titans.

He had watched that darned show until the DVD’s wore out, and then begged and pleaded that his parents replace them. His room was also covered in merchandise, that fortunately Nava and her husband hadn’t bought. He got good grades in school by day and slung French fries by night to fund his expensive habit.

Art was never her son’s strength, but he had tried so hard. The left eye was proportionate while the right eye was…interesting. Overall, Robin looked like he not only had a lazy eye, but that he had also ingested a cocktail of illicit drugs. Even so, her little boy had presented it to her with defiant pride at making something for his mom. She could still remember the cheap paper mache he had wrapped it in, and how he had made her sit down and listen to a prepared speech. It was a birthday gift. And it was precious.

Nava smiled at the memories, still staring out of the window. These days, her son was busy with four children, two dogs, and a wife. Running a successful business on top of that. There wasn’t much time to visit his mother, although he always made the effort to. Nava was looking forward to seeing them in a month or two. Though they lived 3 hours away, the visits were few and far between, and as she continued to age, her daughter-in-law had become more vocal about her concern that Nava lived alone.

She looked down at her face reflected in the coffee. The eyes were now wrinkled and creased, but still burned with vitality and warmth. She had the same white streak of hair on her hairline as her mother, the rest a glory of gray and salt, falling in waves around her face. Her smile lines were deep from a lifetime of smiling and laughing. Her nose, though barely noticeable was permanently crooked. Still a beautiful woman, even at the ripe age of 79.

She looked up and let her eyes wander around the interior of her home. Her late husband had built it with his own hands, and they had created a piece of heaven within those walls. After 52 years of marriage, her darling Henrich had shed his mortality, and now she lived there alone. Her son and daughter-in-law were becoming more insistent that she move in with them, and it was appealing to Nava. She loved her family tremendously, and they were admittedly all she had left. But every notch, every nail, every corner of her house was full of memories. She couldn’t bear to let them go. She couldn’t bear to forget. First steps and homecomings, the first anniversary and the 52nd. It was all too precious.

Her life had been filled with great difficulty and pain, but there was so much beauty to be found. It was all too precious to say goodbye to. Though the dimming of her mind was imperceptible and slow, a desperation to hold onto the intangible had set in, because these were Nava’s greatest treasures, these memories. Where her Henrich now lived. Where her greatest battles were won. Precious…It was all too precious.

- Published in Blog

The RISQ RECAP:

September 19th – September 23rd, 2022

Each week, you’ll find specially curated news articles to keep you up to date on the ever-evolving world of insurance and risk management. The articles are divided out between items relevant to Property & Casualty, Employee Benefits/Human Resources, and Compliance. We’ve included brief summaries of each item as well as a link to the original articles.

PROPERTY & CASUALTY

Damage Assessments Begin in Flooded Alaska Villages

“Authorities in Alaska were making contact this week with some of the most remote villages in the United States to determine their food and water needs, as well as assess the damage after a massive storm flooded communities on the state’s vast western coast this weekend. No one was reported injured or killed during the massive storm – the remnants of Typhoon Merbok – as it traveled north through the Bering Strait over the weekend. However, damage to homes, roads and other infrastructure is only starting to be revealed as floodwaters recede.” Full Article

– Insurance Journal

EMPLOYEE BENEFITS, HUMAN RESOURCES, & COMPLIANCE

Wage and Hour Concerns for Employers of Remote Workers “Employers who allow workers to work remotely, or on a hybrid work schedule, could face challenges related to wage and hour compliance issues under the Fair Labor Standards Act (FLSA). Hourly workers who are not exempt from the FLSA overtime rules, which have no set or enforced policies on where and when they can work, could create major liability for employers under certain circumstances. While there is no way to eliminate the risk of FLSA violations with remote and hybrid workers, employers can take some steps to minimize their risk of lawsuits by employees and enforcement actions by regulatory agencies.” Full Article – Hall Benefits Law LLC

Born Under a Bad Sign: Avoiding Electronic Signature Blues “When Albert King sang “Born Under a Bad Sign,” he was not referring to a document containing an invalid electronic signature. Nevertheless, in a post-COVID world with large numbers of remote workers, employers can take affirmative steps to minimize the kind of “bad luck” the blues singer referred to by understanding issues that may arise when using electronic signatures. Laws at both the state and federal level generally allow electronic signatures to have the same validity as their traditional handwritten counterparts. In an employment context, these laws can cover a wide range of documents, from contracts, to settlement agreements, to restrictive covenant agreements, and more.” Full Article – Akerman LLP

Saving the Employment Relationship “Quiet quitting continues to dominate the headlines. Today’s report in the Wall Street Journal features a Gallup study that suggests nearly half of American workers are “psychologically detached” from their jobs. This study (if true) is troubling for the future of the employment relationship if indifference forms the foundation of that relationship. Indifference can only thrive in a workplace lacking a well-articulated mission the employees believe in. And the feeling of detachment — that someone can phone it in, do the bare minimum, and disown the results — is more likely to exist when an employee senses professional or personal disinterest. So how can the employment relationship be saved in this environment?” Full Article – Mintz

Internship Laws in Review: Ensuring Your Next Internship Program Does Not Run Afoul of State and Federal Labor Laws “As internship season ends, now is a perfect time for employers to review their internship programs to ensure compliance with federal, state and local labor and employment laws. Internships are generally intended to be educational opportunities for students or recent graduates to learn invaluable on-the-job skills, how to effectively work in a specific environment and perhaps earn academic credit or supplement their education post-graduation. Depending on the purpose of the program and a variety of other factors, the internship may be paid or unpaid. In most cases, interns will be considered employees subject to minimum wage and overtime pay, as well as other “employment” obligations such as Workers Compensation, and Unemployment Insurance and federal and state tax withholding.” Full Article – Venable LLP

Resurgence in Criminal Prosecutions for OSHA Workplace Safety Violations – Spencer Fane LLP

“A series of recent criminal prosecutions stemming from workplace fatalities in connection with OSHA’s worker safety laws underscore the Justice Department’s willingness to charge OSH Act crimes, even in the absence of other Title 18 offenses or other criminal charges.” Full Article

NLRB Proposes Return to a More Expansive Joint Employer Standard “One day after Labor Day, the National Labor Relations Board (“NLRB” or the “Board”) issued a proposed rule that would rescind and replace the Trump Administration’s 2020 rule that established the current test for determining whether two entities are joint employers. Predictably, the proposed rule, if adopted by the Board, will result in more findings that two entities are joint employers. Under federal labor law, a joint employer is required to bargain with a union selected by its jointly-employed workers and may be held liable for the unfair labor practices committed by the other employer.” Full Article – Shawe Rosenthal LLP

STATE & INTERNATIONAL COMPLIANCE

In addition to the RISQ Review, RISQ Consulting also provides a resource that features changes and updates to State and International Compliance measures. We’ve included brief summaries of each item below, and also provided links to the original articles if you’d like to read further.

NEW JERSEY

Changes to Posting Requirements Prompt Jersey Employers to Ensure Compliance

“The New Jersey Division on Civil Rights (DCR) recently published final regulations that change the content of certain required notifications New Jersey employers must provide to employees. On August 1, 2022, the DCR announced that these changes are effective immediately and are intended to better inform individuals of their rights under the New Jersey Law Against Discrimination (LAD) and the New Jersey Family Leave Act (FLA). Regulations under the LAD and FLA require covered employers to (1) “display” the official posters in “easily visible” places and (2) “provide” each employee with a copy of the official posters annually and upon an employee’s first request.” Full Article

– Duane Morris LLP

OREGON

Rules Governing Oregon’s New Paid Family and Medical Leave Insurance Program and Equivalent Plan Application Process

“On July 22, 2022 and August 22, 2022, the Oregon Employment Department (OED) published its latest rules governing Oregon’s new Paid Family and Medical Leave Insurance (PFMLI) program. The PFMLI program will be funded by employer and employee contributions in the form of payroll deductions beginning January 1, 2023 and will provide employees with up to 12 weeks of paid time off for leave that qualifies as family, medical, or safe leave, absent undue hardship, beginning on September 3, 2023.” Full Article

– Littler Mendelson PC

MICHIGAN

The Michigan Supreme Court Holds that Discrimination on the Basis of Sexual Orientation is Prohibited by the Elliott-Larsen Civil Rights Act

“On July 28, 2022, in a 5-2 opinion, the Michigan Supreme Court held that the prohibition of discrimination “because of… sex” in the Elliott-Larsen Civil Rights Act (“ELCRA”) includes discrimination on the basis of sexual orientation. Rouch World LLC v Department of Civil Rights, No. 162482, July 28, 2022.” Full Article

– Dickinson Wright

MISSISSIPPI

Protections for Employers Under the New

“Mississippi Medical Cannabis Act that was signed by Gov. Tate Reeves in February 2022 was written in a way to protect employers. Here are some protections that employers will see under the new law. Some of the protections offered are; employers are not required to pay for or reimburse any individual or entity for cost associated with the medical use of cannabis, no employer is required to permit or accommodate the medical use of cannabis and employers are not prohibited from hiring or discharging the privilege employment because of an individual’s use of medical cannabis.” Full Article

– Phelps Dunbar LLP

CALIFORNIA

California Creates Unelected Council to Set Minimum Wages/ Working Conditions of 500,000 Fast Food Workers

“On September 5, 2022, Governor Gavin Newsom signed the Fast Food Accountability and Standards Recovery Act or FAST Recovery Act (AB-257). The state government, which is dominated at all levels by union-friendly politicians, will appoint a 10-member Council composed of employees, employers and “union activists” to set the minimum wages and working conditions of fast food workers in the state – however, the new Council will only have jurisdiction over non-unionized fast food restaurants. Since unionized restaurants will be exempted from the law, they will be free to pay their employees lower wages and benefits than those set by the Council.” Full Article

– Proskauer Rose LLP

- Published in Blog

Understanding the “Quiet Quitting” Trend

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

“Quiet quitting” is an emerging trend where workers only do what their job description entails without going above and beyond. Over the course of the COVID-19 pandemic, many employees shifted their views on their work lives, and this has been reflected in movements such as the Great Reshuffle—a mass movement of workers to jobs that meet their demands for things such as more flexibility and better benefits—the shift to remote work and, now, the quiet quitting trend.

Employees who solely complete their job description and no more could continue to be valuable workers. However, employers can consider steps to engage employees and prevent quiet quitting from happening in the first place. To help eliminate the trend’s presence in their organizations, employers should focus on effective communication with their employees and methods to enhance employee engagement.

Signs of Quiet Quitting

Research conducted by Gallup found that only 32% of employees are engaged, and 17% are actively disengaged. Employees who are not engaged could be at risk for doing only their job and not going above and beyond. Further, 53% of workers reported they feel burnt out, according to Talkspace’s Employee Stress Check 2022 Report. To improve employee engagement and prevent these issues from turning from quiet quitting into actual quitting, employers need to know what signs to look for. Employers should pay attention to employees who are consistently doing the following:

- Not attending meetings that are not mandatory

- Not being as productive as they once were

- Contributing to team projects less

- Not participating in meetings

- Displaying a lack of enthusiasm

It is important to know that there a several reasons an employee may choose to quiet quit. For example, they may simply refuse to do work outside their job description because they feel they are not being compensated for it. While it may not be clear why an employee is choosing to quiet quit, these signs are a good indicator that an employee may be thinking about it or trying to do so.

What Employers Can Do

Quiet quitting is often the result of decreased motivation and burnout. Further, a lack of effective communication between leaders and employees and a general failure of management and organizations can play a role. For example, failures may include a lack of honesty with employees and not delivering on promises. Consider the following ideas to help improve employee engagement and decrease the odds of quiet quitting among employees:

- Provide clear job descriptions. Job descriptions let employees know exactly what is expected of them. Employers should review job descriptions to ensure they accurately reflect the duties they expect their employees to perform.

- Conduct performance reviews. Performance reviews are opportunities to reward employees for the positive things they have done and inspire them to continue working hard. Without this feedback and indications of appreciation for hard work, such as title adjustments and salary raises, employees could lack motivation and start to feel burnt out and consider quiet quitting. Further, it is important to recognize employees who go above and beyond because they are likely to feel discouraged and decrease their performance if their contributions go unnoticed. Conversely, performance reviews are just as important for underperforming employees because they are opportunities to clearly communicate expectations and work together to correct the behavior.

- Educate employees on employee handbooks. Employee handbooks are another tool employers can use to clearly communicate expectations to employees, but they are only truly effective if employees understand them. Employers should take time to educate employees on their handbook and its policies so they can ensure employee understanding. The handbook should be reviewed and updated regularly to ensure that expectations are up to date and that organizations are in compliance with current laws.

- Provide learning and development opportunities. High employee engagement is crucial to preventing quiet quitting. One effective way to increase engagement is through learning and development initiatives. According to Zywave’s 2022 Attraction and Retention Benchmarking Overview, 29% of employers found career development opportunities to be a top priority of workers during the hiring process. Employees who have these opportunities are more likely to remain engaged and stay motivated to try their best at their jobs.

- Focus on good management strategies. Effective management is essential to having efficient, happy employees, so it is important to focus on the techniques managers use. Provide resources to managers about effective strategies and meet with them to discuss ways they can improve. Further, consider conducting skip reviews, where employees talk with their manager’s manager to discuss feedback or concerns they may have. This will allow the manager to receive helpful feedback that can be mutually beneficial and improve their employees’ experiences.

Takeaway

Quiet quitting is the new term for the trend of employees doing only what their job requires without exceeding expectations. Employers should be aware of the trend and that it will impact every workplace differently. Employers should monitor for signs that employees may be disengaging and utilize different strategies to help prevent quiet quitting. In cases where quiet quitting may be negatively impacting the employer and they cannot seem to resolve the issue, employers should ensure compliance with federal and local employment laws before pursuing any termination action. For specific guidance about disciplining employees, employers are encouraged to seek local legal counsel.

Contact RISQ Consulting today for more information on workplace trends, employee retention and employment laws.

- Published in Blog

Hot, Mushy, Root Tuber Soup

By Jennifer Outcelt, Creative Content Architect

Are you bad at going to the grocery store? I don’t mean like you have trouble physically walking through the doors and keep bumping into the outer façade, because that would be ridiculous and a cause for true concern about your depth perception… also, maybe don’t drive to the store (or at all) if this is happening to you. But that is NOT the question I’m asking here.

What I’m asking is: Do you have trouble recalling all the things in your kitchen at any given time and mentally comparing that to the food items you would like to cook for the week and then translating the delta items on to a grocery list and then successfully sticking to that list with no more or no less coming back home with you to perfectly execute your weekly recipe goals? Yeah, me too.

Recently I told my husband that we needed more carrots while he was on his way to Costco. Spoiler alert, we did not need more carrots. In fact, we already had a greater than normal amount of carrots in the fridge because the week prior, when my husband went to Costco, he had bought carrots. So when he returned I found myself in possession of 8 pounds of carrots. Which is somewhat inconvenient since no one in my family has a Bugs Bunny level obsession with carrots.

So what do you do when life gives you carrots? Do you make carrotaide? No. You make carrot soup. Why? Because it’s fall and hot, mushy, root tuber soup sounds nice. Here is the recipe I followed to get rid of 2 pounds of my carrots. I found it exceptionally and surprisingly delicious. Don’t skimp on the Greek yogurt or za’atar seasoning at the end either!

https://www.mykitchenlove.com/roasted-carrot-soup/

Also, I can not help you with avoiding these grocery shopping mistakes. I apologize if I misled. I really just wanted to create some validation for you and show that you are not alone. Or at least I hope I’m not alone.

- Published in Blog

The RISQ RECAP:

September 12th – September 16th, 2022

Each week, you’ll find specially curated news articles to keep you up to date on the ever-evolving world of insurance and risk management. The articles are divided out between items relevant to Property & Casualty, Employee Benefits/Human Resources, and Compliance. We’ve included brief summaries of each item as well as a link to the original articles.

PROPERTY & CASUALTY

US Aims to Reverse Some Trump Offshore Safety Rule Rollbacks

“The U.S. Department of the Interior said Monday that it wants to reverse some Trump administration rollbacks of offshore safety rules to prevent blowouts like the BP catastrophe that killed 11 people and fouled the Gulf of Mexico in 2010.” Full Article

– Insurance Journal

EMPLOYEE BENEFITS, HUMAN RESOURCES, & COMPLIANCE

ERISA Lawsuit Time-Barred Due to Plan’s Limitations Period “In reaching this determination, the Eleventh Circuit concluded that it was irrelevant that the plaintiff was not given actual notice of the limitations provision.” Full Article – The Wagner Law Group

Fifth Circuit Rules in Section 1557 Litigation “The decision means that HHS is permanently barred from interpreting or enforcing Section 1557 in a way that would require the religious plaintiffs in Franciscan Alliance to perform or provide insurance coverage for services related to gender transition or abortion. This article discusses this case and also summarizes the status of other litigation over rules to implement Section 1557.” Full Article – Health Affairs

District Court: ACA’s HIV/Prep Coverage Mandate Violates Religious Freedom Restoration Act “In a dispute involving the ACA’s preventive health services rules, a Texas district court held that the coverage mandate for preexposure prophylaxis (PrEP) drugs to prevent HIV infections violated an employer’s rights under the Religious Freedom Restoration Act of 1993 (RFRA). The district court also addressed the appointment process for the entities that determine which items and services must be covered under the ACA’s preventive health services rules, as implemented.” Full Article – Thomson Reuters Practical Law

Agency FAQs Reveal Employers Continue to Struggle with Implementation of No Surprises Act and Transparency in Coverage Requirements “The DOL, HHS and the Treasury recently issued joint guidance in the form of FAQs which [1] elaborate on and relax the requirement that plans make machine-readable files publicly available on the plan’s website no later than 7/1/2022 [2] specify the three ways in which plans and issuers must satisfy the notice obligation, and [3] clarify how protections would apply for plans with no network (e.g., reference- based pricing plans) or plans that only extend in-network coverage.” Full Article – Seyfarth Shaw LLP

Benefits-Related Provisions of the Inflation Reduction Act of 2022 – Groom Law Group

“On August 16, President Biden signed into law the Inflation Reduction Act of 2022 (P.L. 117-169; the “Act”). Although the Act differs considerably from the wide-ranging domestic economic package Democrats had initially envisioned under the Build Back Better moniker, the Act nevertheless includes a number of significant initiatives addressing the climate, healthcare, and tax issues. …[1] Extension of ACA subsidies [2] Medicare prescription drug pricing negotiations [3] Manufacturer rebates under Medicare [4] HSA safe harbor for insulin.” Full Article

Hospital and Insurer Price Transparency Rules Now in Effect But Compliance Is Still Far Away “The short answer to the question of whether these transparency rules are working is not quite yet. Hospitals have been slow to comply with transparency rules. Even when hospitals have complied with the rules, experts have found the data to be ‘consistently inconsistent’ in terms of how data elements are defined and displayed, making it very difficult for third parties to make connections across hospitals and payers.” Full Article – Health Affairs

STATE & INTERNATIONAL COMPLIANCE

In addition to the RISQ Review, RISQ Consulting also provides a resource that features changes and updates to State and International Compliance measures. We’ve included brief summaries of each item below, and also provided links to the original articles if you’d like to read further.

NEW JERSEY

Establishing Independent Contractor Status Continues to Challenge New Jersey Employers

“In East Bay Drywall, LLC v. Department of Labor & Workforce Development, decided on August 2, 2022, the New Jersey Supreme Court confirmed the difficulties employers face when trying to establish independent contractor status for their workers.” Full Article

– Cole Schotz

NEW YORK

New York City Will Soon Regulate Use of

Artificial Intelligence in Employment Decisions

“On January 1, 2023, New York City employers will have to comply with a new law aimed at preventing bias in artificial intelligence hiring tools. These tools, which include algorithms and software geared towards finding ideal candidates, have come under fire in recent years for their potential to unlawfully discriminate against protected classes.” Full Article

– Benesch Friedlander Coplan & Aronoff LLP

New York Adult Survivors Act: What Employers Should Know

“The Adult Survivors Act, a law recently signed by New York Governor Kathy Hochul, will go into effect on November 24 and provide a one-year window for individuals to bring certain previously time-barred sexual offense claims, regardless of when the alleged act occurred.” Full Article

– Morgan Lewis & Bockius

COLORADO

Colorado Expands Notice Requirements for Employees Upon Termination

“When a Colorado employee’s employment terminates for any reason, employers are required to provide certain information to the employee regarding unemployment insurance benefits. Colorado expanded employers’ notice requirements under Senate Bill 22-234, which was passed on May 25, 2022.” Full Article

– Cooley LLP

NEVADA

Nevada Supreme Court Affirms Termination for Off-Duty Recreational Marijuana Use

“Ending years of discussion about the scope of state law employment protections for individuals who use marijuana recreationally, the Nevada supreme Court has upheld a lower court’s decision to dismiss a complaint by an employee who was fired for testing positive for marijuana on a post-accident drug test.” Full Article

– Littler Mendelson

- Published in Blog

Coping With A Serious Diagnosis

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

Getting an unexpected health diagnosis can flip your world upside down. Upon receiving a serious diagnosis, you must evaluate treatment options and consider how it will affect your life, health, job and finances. On top of all that, you will also need to manage the emotional toll receiving a diagnosis may have on your well-being.

This article explores the general stages of grief one may go through after receiving a serious diagnosis and tips for coping with the news.

The 5 Stages of Grief

Grief is an experience that can completely consume you mentally, physically and emotionally—and it doesn’t just happen with the traditional sense of loss. The grief that accompanies a life-changing diagnosis is complex.

Psychiatrist Dr. Elisabeth Kubler-Ross proposed a framework referred to as the “five stages of grief”: denial, anger, bargaining, depression and acceptance. Consider the following five stages of grief that you may experience following a serious diagnosis:

- Denial—Denial is the act of rejecting reality. It often comes first in the stages of grief because the mind and body have to work to process the significant life change. In this stage, you might downplay the severity of the situation to cope by rejecting pain, ignoring symptoms or hiding symptoms from loved ones.

- Anger—A strong emotion you might experience is anger. This feeling may be directed at yourself, your doctors or even the world. This phase is helpful since anger allows you to start feeling again and examine how you feel about the situation.

- Bargaining—Though this stage isn’t the same as denial, bargaining may feel similar because you’re thinking of how the situation could have gone differently. This is considered the “what ifs” stage, and people often seek a second onion hoping for different results.

- Depression—Grief and depression go hand in hand. You may pull away from loved ones or feel sad or lonely. When faced with a serious diagnosis, you may also be mourning the loss of your former and healthier self and the life that went with it.

- Acceptance—The final stage is achieved when you’ve come to terms with the diagnosis and have stopped any internal fights against it. You accept your life will be different and start taking steps to manage the condition better and improve your health.

These stages are attempts to process change and protect yourself while you adapt to a new reality. Once you’ve cycled through these stages of grief, you’re more likely to be open to coping strategies.

Tips for Coping With a Diagnosis

You’re likely to be flooded with a wide range of emotions when given a serious diagnosis. Everyone responds differently, but consider the following ways to take control of the situation:

- Give yourself time to process the news. You’ll likely need to go through the five steps of grief—which takes time—to work through any emotions. Don’t hold back on sharing your feelings with family members and friends.

- Get the facts. Learning as much as possible about your condition and treatment options is essential. Ask for resources from your doctor or pharmacist and search reputable online sources (e.g., government websites, condition-specific websites and medical journals).

- Create a support system. It can be helpful to have a network of people (e.g., family, friends, neighbors and others with the same diagnosis) to lean on and talk to during your treatment or recovery. Remember that it’s OK to accept help during a difficult time.

- Focus on healthy habits. Talk to your care team to understand the best lifestyle choices, nutrition and exercise options for your condition. Maintaining a healthy lifestyle can also help improve your energy level and mood.

- Stick to your daily schedule. Routine is important, and staying busy can positively impact your mental health. Just as you’d schedule time for work or social activities, be sure to include sufficient downtime to recharge.

- Make time for your favorite activities. What has been comforting before your diagnosis will likely still ease any worries. If needed, modify your activities to still participate in them. Don’t dwell on your limitations or compare your situation with how things used to be.

Depending on the diagnosis and your health situation, be open to trying new activities or other coping strategies. For example, journaling or seeking a professional mental health provider can be healthy outlets to help you navigate the condition and move forward mentally.

Summary

It isn’t always possible to prepare for life-changing news, and it’s a learning process to figure out how to cope with a difficult health diagnosis. However, you can find a way to adapt to the changes coming with some time and patience.

As you cope with a serious condition, it’s crucial to prioritize your physical, mental and emotional health. If you’re struggling to stay positive most days or are held back by fear and anxiety, it may be helpful to seek professional help. Bring up any concerns to your doctor or use the Substance Abuse and Mental Health Services Administration’s National Helpline by calling 800-662-HELP (4357).

- Published in Blog

Tips for Effective 2023 Open Enrollment Communication

This article is from RISQ Consulting’s Zywave client portal, a resource available to all RISQ Consulting clients. Please contact your Benefits Consultant or Account Executive for more information or for help setting up your own login.

Now more than ever, employees are looking to their employers for guidance on navigating their available benefits and how to stretch their dollars further. As such, effective open enrollment communication is critical this year. According to a Voya Financial survey, nearly one-third of American workers (31%) eligible for benefits admitted they don’t fully understand any employee benefits they selected during their most recent open enrollment period. However, employees are likely paying more attention this year as they also navigate record-high inflation and work to maximize every hard-earned dollar.

Many of today’s workers want help understanding how much money to put aside for retirement, emergency savings and health care expenses. That means employers have an opportunity to shine by effectively communicating and guiding employees throughout the open enrollment process and even the rest of the year.

As the 2023 open enrollment season approaches, employers are poised to provide their employees with resources and digital tools they can use to better understand and act with more confidence when making benefits decisions. This article highlights communication tips for employers.

Communicating With Employees

Educating and informing employees about their benefits package is an integral part of open enrollment. Effective communication is critical to educate and inform employees about new, returning or expanded benefits options. Consider these eight communication tips:

- Start early. Get the word out early about benefits offerings so employees have ample time to understand their benefits, consult with family members and determine their needs for the following year. There’s no such thing as communicating “too soon” about enrollment. Research shows that repetitive messaging and reminders increase the odds of an employee seeing enrollment information and understanding the upcoming benefit changes and how they work.

- Develop key messaging. After solidifying benefits options, employers need to plan their communication strategies. The first step is figuring out key messaging, focusing on new or updated benefits offerings, and developing FAQs to address common concerns quickly.

- Select a mix of appropriate channels. Just as many workplaces operate in a hybrid model, employee communications can be successful when done in a similar manner. For example, digital channels can help distribute and house information virtually, allowing employees to access it when and where they need it. Chat functionality with benefits vendors can also be a helpful digital tool to assist employees in figuring out which benefits they need. Alternatively, there’s still a time and place for companywide on-site meetings and mail-to-home print communication. Postcards and other mailers are still relevant and can serve as a reminder to discuss and review benefits options at home. Every workplace is different, so it comes down to selecting various channels that are relevant and engaging to each organization’s specific employees.

- Keep it simple. It’s vital to simplify any benefits information being shared. Employees don’t need to know everything, so employers should highlight what’s necessary to understand about the benefit and the information to help them decide if they need it. Links or attachments could explore the benefits further and offer the fine print.

- Make it digestible. It’s crucial to catch employees’ attention and present the key message immediately before they lose interest. Traditional benefits booklets can be lengthy; instead, employers could deliver bite-sized information to employees through methods such as videos and emails. If all open enrollment information is given at once, it’s easy for employees to become overwhelmed and, ultimately, disengage with employer-provided information. Digestible communication makes it easy for employees to know what to focus on and take action.

- Use real-world examples. When possible, employers can put benefits offerings in context with real-world scenarios. Employees can relate to stories, so find ways to bring the options to life. For example, instead of describing telemedicine as a 24/7 benefit, highlight that an employee could get health care answers in the middle of the night when they or a child are running a high fever. The chances of employees needing to use health care benefits during the next year are highly likely, so help reiterate the importance of complete coverage.

- Avoid jargon. Avoiding HR or benefits-related jargon is best to help make benefits easier to understand. Additionally, many benefits are acronyms, so employers should help decode and explain the alphabet soup to employees.

- Personalize communication. Ultimately, employers want to engage employees with open enrollment information, and a personalized approach can help. It’ll depend on the workforce and their working environments, but employers will likely need to segment their employee audience and tweak messaging so it resonates. For example, open enrollment methods and communication would look different for remote, on-site and nonwired employees.

Benefits can be complicated. Although open enrollment is the most pivotal time to highlight benefits to employees, employers have an opportunity to educate employees throughout the year. Ongoing communication after open enrollment can help encourage employees to understand and utilize the benefits available to them.

Summary

Educating and informing employees about their benefits options is an important part of open enrollment. Effective employee communication is an ongoing process, but it comes down to helping employees feel well-informed about their benefits options and confident about their choices.

Reach out to RISQ Consulting for additional open enrollment support, including employee communication resources.

- Published in Blog

- 1

- 2

Subscribe to the RISQ Recap, a weekly post to help you stay up to date on news articles and resources for your organization’s compliance needs.

Subscribe to the RISQ Recap, a weekly post to help you stay up to date on news articles and resources for your organization’s compliance needs.